I’ve always been fascinated by the concept of trading bots and the prospect of automating and streamlining a trading strategy. So much so that I decided to build Aesir, a cryptocurrency trading bot platform, with a small team a few years ago. When we started, one thing was pretty clear to us. Most algorithmic crypto trading bot platforms out there fall into one of two categories:

I remember trying to build a simple multi-asset DCA strategy on one of the leading tools at the time. The interface was cluttered with so many buttons, knobs, and configuration options that it felt more like the control panel of a rocketship than a setup page for a basic trading strategy. That was just not good enough. After some thinking, I broke the problem down into two parts: only the relevant configuration options should be visible at any time, and the entire logical flow should be easy to understand.

After several prototypes and concepts, I decided to transform a linear form-like builder into a whiteboard-style interface, similar to the likes of Miro.

I’m excited to say that after many hours of working on it, the Visual Builder is finally live on our crypto trading bot platform Aesir!

To get a real sense of how it works, you can watch this video I made where I build a trading bot from scratch using the Visual Builder:

This approach aims to solve the two core issues present in most other algo crypto trading bot platforms out there.

Contained Logic Nodes

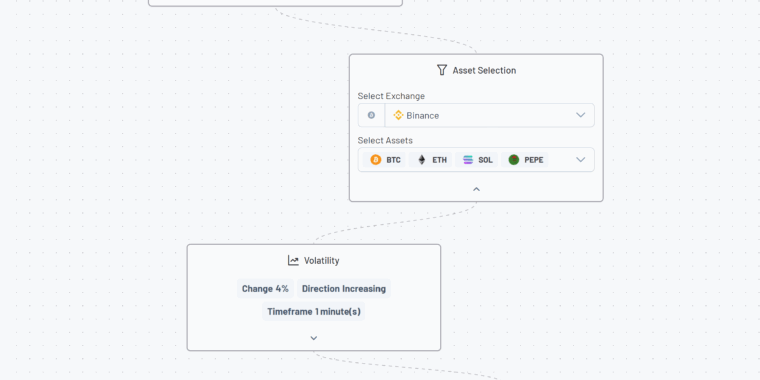

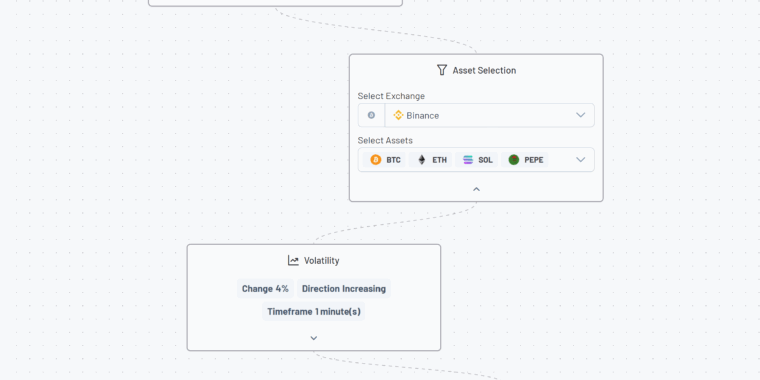

By creating individual nodes, each piece of logic is contained in a neat box, where every configuration option is directly relevant to that particular logic node. No clutter, no overly complicated control centers, and no outer space resistance training required to use it.

To achieve this, the Visual Builder includes the following node categories:

-

Core Nodes: Allow you to add your basic logic, such as the amount spent per trade, the coins to analyze, and the bot frequency.

-

Logic Nodes: Enable you to build the actual strategy for your trading bot. This may include volatility-based trading, indicator comparison, computed indicators via TradingView, or a combination of any or all of these logic node types.

-

Exit Nodes: Let you define the exit strategy for your trading bot.

Once you’ve built your strategy, you’ll be able to easily understand the logical flow and what it’s supposed to do. Just follow the flow you’ve built:

This is an example of a trading bot that buys Bitcoin, Ethereum, Solana, and Pepe whenever any of these assets gain at least 5% within a 10-minute window. It will then either sell at a loss of 15% or a profit of 45%. It’s that simple.

You can expand or collapse the nodes to further simplify the interface and focus only on what matters to you. The Visual Builder in Aesir revolutionizes the way users create their crypto trading bots by offering an intuitive, whiteboard-style interface. This feature allows both novice and experienced traders to design complex trading strategies without the need for programming knowledge.

Only crypto trading bot platform using logic nodes

At the heart of the Visual Builder’s nodes are the logic layer nodes. Let’s explore these in a bit more detail.

Volscan: Capitalizing on Crypto Price Volatility

Volscan is a logic layer designed to analyze the percentage change in asset prices over a user-defined time period. This feature empowers traders to set specific thresholds that, when met, automatically trigger buy orders based on an asset’s price movement.

It’s an excellent way to take advantage of market volatility without needing to constantly monitor price charts.

For example, imagine you’re tracking a cryptocurrency and want to capitalize on rapid price increases. You could configure Volscan to monitor the asset’s price over a 10-minute window and execute a buy order if the price jumps by 5% or more during that time. This automation allows you to seize opportunities from sudden price spikes—say, during a market rally—without being glued to your screen.

The beauty of Volscan lies in its flexibility. Traders can tweak the time period (e.g., 5 minutes, 1 hour), the percentage threshold (e.g., 3%, 10%) as well as the direction of the volatility. So you could be scanning through hundreds of exchange assets, and immediately open positions on the ones that match your volatility setup.

Computed: Using TradingView inside a crypto trading bot platform

Computed Indicators bring the power of pre-computed technical indicators from TradingView directly into your trading toolkit. These indicators analyze market data and deliver straightforward signals—“BUY,” “SELL,” or “Neutral”—based on TradingView signals. This feature simplifies technical analysis, allowing traders to make informed decisions without diving into complex calculations themselves.

What sets this apart is the ability to combine multiple indicators for a more robust strategy. For instance, you might select a mix of popular indicators like moving averages (to track price trends), RSI (Relative Strength Index, to gauge overbought or oversold conditions), and MACD (Moving Average Convergence Divergence, to spot momentum shifts). By layering these indicators, you get a fuller picture of market conditions.

To fine-tune your approach, you can set custom thresholds. For example, you might require that at least two out of three chosen indicators signal “BUY” before a trade is executed. This reduces the risk of acting on a single false signal, like a fleeting price dip, and increases confidence in your trades. It’s perfect for traders who want to harness technical analysis efficiently, whether they’re refining a simple strategy or building something more intricate.

Advanced: Complex logic and custom indicator analysis

The Advanced layer allows you to create complex conditional logic by integrating various indicators and Kline data (candlestick chart data), enabling highly customized rules for when your bot enters or exits a trade. This layer is all about giving you the reins to design a strategy that perfectly fits your trading philosophy.

For instance, you could craft a buy condition that triggers only when multiple criteria align, such as:

The asset’s price is above its 50-day moving average (indicating an uptrend), the RSI dips below 30 (suggesting the asset is oversold), the trading volume spikes by 20% or more in the last hour (showing strong market interest).

This granular control lets you optimize for specific scenarios, like catching undervalued assets in a bull market or minimizing losses during a downturn.

The Advanced feature shines for those who’ve outgrown basic automation and need a platform that can handle sophisticated logic. It’s like a blank canvas for your trading ideas, offering the flexibility to combine indicators, timeframes, and conditions in ways that align with your expertise and goals.

Each logic node is contained within a neat box, ensuring only relevant configuration options are visible, reducing clutter. Users can expand or collapse nodes to focus on specific parts, enhancing usability. For example, a trading bot might buy Bitcoin, Ethereum, Solana, and Pepe when any gains of at least 5% in 10 minutes, selling at a 15% loss or 45% profit. The logical flow is easy to follow, making it straightforward to understand and adjust the strategy.

By providing such an intuitive interface, Aesir sets itself apart from other algo crypto trading bot platforms, making algorithmic trading accessible to a wider audience.

The tool currently works with Binance, Coinbase, and Kraken, and we have plans to expand to other exchanges soon.

If you’re into algorithmic trading and looking for a no-code solution, check out crypto trading bot platform Aesir. Get 20% OFF with code AESIRPOT20.

Enjoyed this article?

Sign up to the newsletter