Let’s pick up form where we left off last week – we coded a simple backtesting algorithm for our cryptocurrency trading needs. In other words, we wrote a script that will help us asses how profitable out trading strategy would be by running it over historical data.

More importantly, I pointed out how back-testing (or anything that doesn’t include YOLOing your life savings on calls) would probably enrage your /r/wallstreetbets purists.

In this post, I’ll share some improvements that I made to the backtesting crypto algorithm this week, and also share my own results after testing out the same strategy for: BTC, XLM, ICP, ETH and DOT.

The changes

Multi coin support for downloading historical data.

- You can now define which coins to download historical data for in the coins.txt file

- Data fetching is run on separate threads so the files are generated concurrently

- Careful not to add to many coins at ones (Binance may temporarily ip-ban you)

Automatic conversion of trade_size

- In maintester.py trade_size now represents the USDT volume to buy

- This is then automatically converted into the coin bought (ie: trade_size = 10k is equivalent to a trade order of 0.03 BTCUSDT)

- This is calculated whenver a historical trade is placed so it’s in line with the historical price at that time.

Multicoin backtesting support:

- With the addition of threaded historical data download, it makes sense to pass all the data to the backtester

- this is not threaded and will run sequentially, to avoid making a mess in the logs.

Download the latest backtester for crypto trading here and check out the set-up guide here

The results

I created the following trading strategy and applied to the historical price data for BTC, XLM, ICP, ETH and DOT.

- Initial balance: $100k

- Volume / trade: $10k

- Buy if the price now is higher by at least 1% compared to 1 minute ago

- Sell at 5% loss

- Take profit at 10%

Bear in mind that this is a simple strategy that more than anything else displays how the backtester works. You should run your own variables, or include a trailing stop-loss to increase your profits.

BTC – 10% loss

Overall, the this strategy underperformed on BTC, with a final balance of 55k. However, hour value is around 90k which means some trades remain open. There are two issues with this strategy:

- There is no risk management. Yes we have a stop loss, but this strategy could benefit from a signal that stops us from buying in a bearish market.

- There is no trailing stop-loss. We could ride the bull for much higher than 10% thus maximising our profits.

With that in mind, let’s see how the remaining coins have performed (without the above points).

XLM – 37% profit

Looks like we’re 37% in profit on XLM since the start of the year. Doesn’t beat buy and hold though.

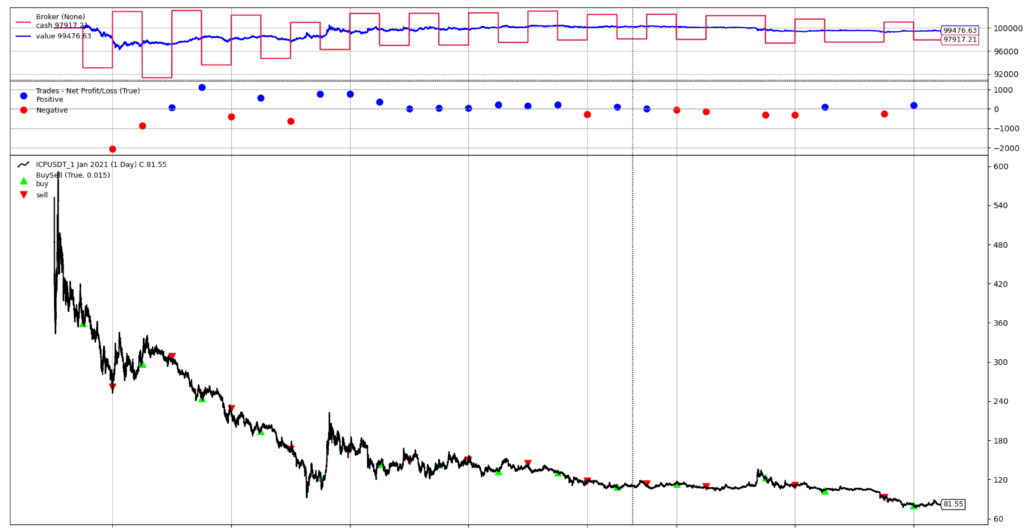

ICP – breaking even

And that’s a great result considering ICP did little else but plummet ever since it was listed on Binance.

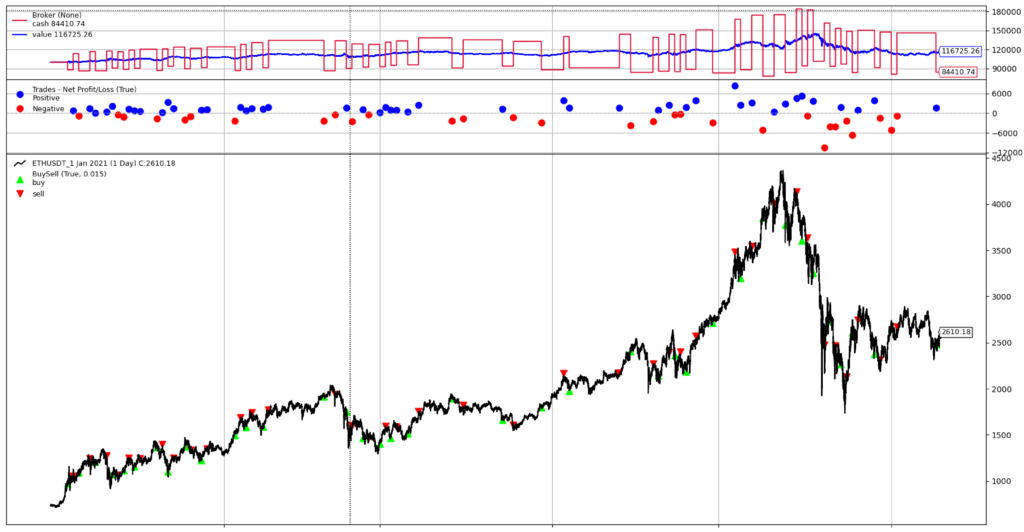

ETHUSDT – 11% in profit

Similarly to Bitcoin, the bulk of the losses happen during the correction from ATH. Again, a signal to help us stop from buying while the market is in free-fall would help maximise our profits – something to look forward to in the next article.

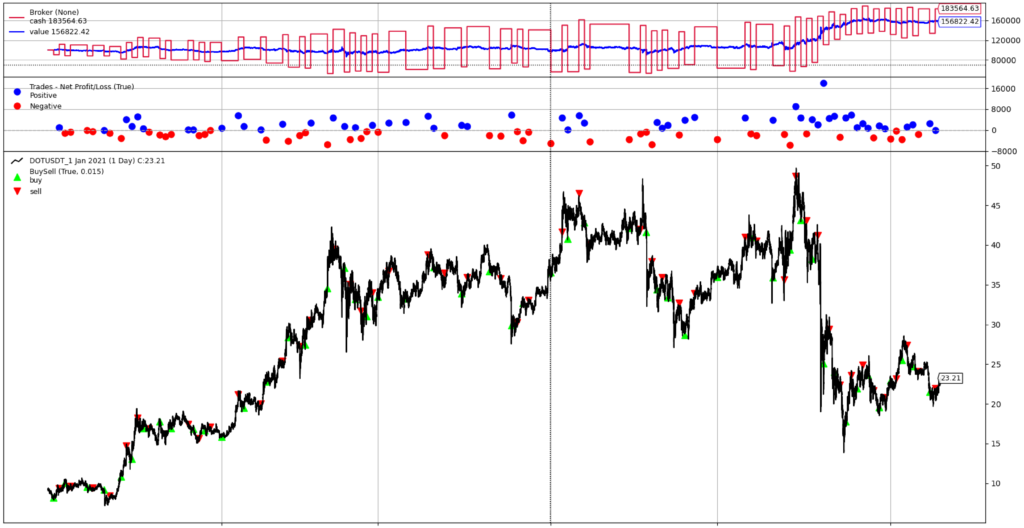

DOTUSDT – 83% profit

This is really good result! Without any other optimisation we’re almost beating the buy-and-hold for DOT.

Stay tuned, as I’ll be adding more features to the backtesting crypto algorithm, to further improve its profitability and use cases!