Most people lose money trading, so the theory goes — if you could place the opposite of their trades, would that turn you into an unstoppable money-making machine?

Maybe the question hits closer to home, maybe you yourself are the best test-subject for this theory. I know I definitely am when it comes to day-trading. That’s why I built a Chrome Extension that will invert my own Binance trades (source code linked).

So every time I would place an order on Binance, the extension would ensure that the opposite order goes through: Sell = Buy and Buy = Sell. With this all set up and working it was time to formulate the plan of action and test this strategy out.

What are Derivatives or Binance Futures?

First off, this strategy is best suited on derivatives or Futures trading. That’s because an inverted “Buy” order on Spot trading would only work if you pre-own that asset. Say you’re Buying BTC on Binance Spot trading with the extension enabled, but you don’t own any Bitcoin — nothing would happen in this case, as you’re trying to sell an asset that you do not own.

So in order to avoid this situation, the extension would have to tested on derivatives. Unlike Spot trading where you trade the actual asset, on derivatives you’re actually trading a contract that’s based on the value of the underlying asset. This allows you to place a Sell order without having to pre-own the underlying asset.

Methodology: Reversing your trading strategy

I loaded up by Binance Futures account with some money that I wouldn’t mind losing and went to town. The extension is working as it should.

I am not a day-trader. I am mainly a holder that DCAs in and trades on much longer timeframes — usually a few months. So when I do daytrade, I am guaranteed to lose money. Reverse-me would become Warren Buffet in no time.

The testing period took about a week’s time, with the extension enabled and trades made on 5m and 15m charts. Each trade took anywhere between 10 minutes to 12h to close, so relatively tight.

Test Results: Reversing your trading strategy

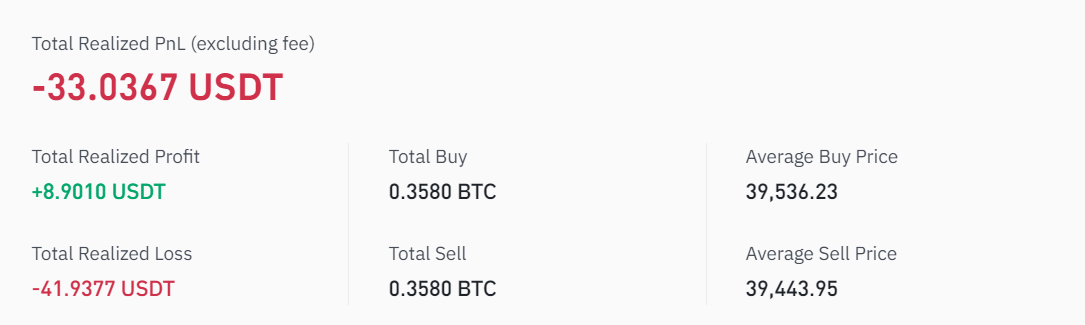

After about a week of testing, I was doing about 50%. Not quite what I was expecting. Though the theory could be tested more accurately as a couple times the extension was not enabled, so that could have very well skewed the results.

At best— This means that I’m probably a better day trader than I thought and should be able to make profit trading normally.

At worst— If I had broken even, that would put me in a very difficult spot. Not good enough to make money trading normally, but not quite bad enough profit from the reversed trades.

What does that mean for this experiment?

These results show that the success of a trade reversal strategy is not only dependent on when you enter the market, as this only paints half the picture. Your exit strategy is equally important, especially on short timeframes where the volatility is off the charts.

This experiment could have been measured better, however it does seem that the human variable within this system is what caused the losses to occur. In order words, I will stick to long term trading, and keep on building crypto trading bots that will trade short-term on my behalf.

However, I do think that, if implemented correctly a reversal strategy would indeed work. Maybe it needs to be hooked up to a losing account so it copies the reversed of existing trades? If you’re an average trades that’s consistently losing money, we might be able to test this out together.

Finally, here is how I built the extension in case you’re interested in the techy bits: https://youtu.be/3QAJWENW-20

Yeah I tried this strategy but lost money on both accounts. 😂😂 It’s not with your bot tho.

I have tried 3 commas DCA BOT and it has lost me a ton of money. I am wondering if I can get an exact reverse of that bot it be a nice experiment.