I would like to start by saying that I’m excited to finally be able to write this article, and share this project with the world.

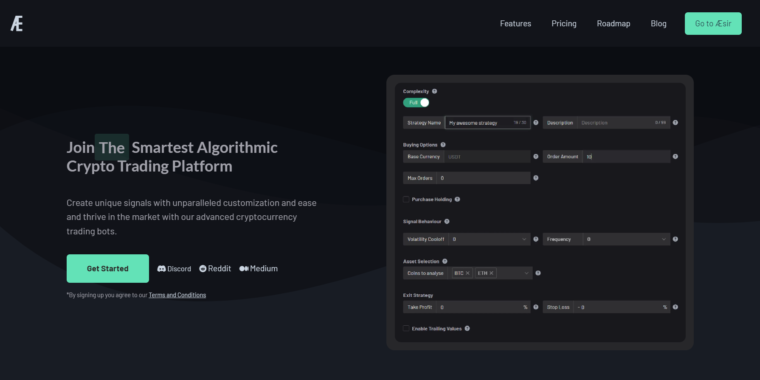

I’m excited to finally be able to share the origin story of Aesir, an algorithmic cryptocurrency trading platform that I built alongside a small team of developers for the past couple of years.

The work on Aesir started in March 2021 with the goal of revolutionizing cryptocurrency trading bots and algorithmic trading by providing a platform with unique signals and a community-driven approach.

How do Algo Trading Platforms Work?

In order to understand why a tool like AESIR can be incredibly helpful for both new and experienced crypto traders alike, it’s good to have a top level understanding of how they work. Algorithmic Trading Platforms work by allowing the user to create a series of rules, that the platform is going to evaluate and execute. For instance, these rules can be as simple as a weekly DCA:

Buy BTC, ETH, DOT and SOL EVERY 1 Week, With an Order Amount of 100 USDT

The crypto trading bot will then act on your behalf by executing trades according to the parameters that you gave it. This is just a minimal example, you can create strategies that contain complex logic based on Volatility, Technical Indicators and other market tools —

Could also do something like this.

Buy ANY COIN on THIS EXCHANGE that GAINED more than 3% in the 2 MINUTES and the RSI is under 70

Now that’s more like it. In this example you can clearly see the advantages that a crypto trading bot has over manual trading. Even the most competent day trader would not be able to analyse hundreds of assets in a single moment, and immediately make a decision based on this. With a trading algorithm, traders are able to perform such quantitative analysis, opening up opportunities in trading that were previously not possible.

So in a nutshell, a cryptocurrency trading bot extends your ability to trade by adding powerful new tools in your arsenal. It goes without saying that the way you use these tools makes a big difference.

Building principles for our Trading Bot Platform: Aesir

The great thing about Aesir is that before actually starting to build it, I had the opportunity to talk to hundreds of people in crypto and trading and determine what are the most requested features for such a platform, and how to build it in a way that both enthusiasts and professionals alike can benefit from it.

We combined this research with the numerous reddit and discord conversations around the kind of features that people expect from a algorithmic trading app, and apart from the usual “I want it to make me profit” we found out that many people tend to value guidance, learning and the ability to grow along with something. Many algorithmic trading platforms out there require the user to already possess specialised knowledge before they can use the application. You can’t really completely remove complexity, since specialised knowledge is needed, but you can make it so people learn from one another, and share the knowledge collectively.

AESIR Features

That’s why we decided to build social mechanics into AESIR. Here is a quick preview of the Leaderboard and Copy Trading —

Leaderboard & Copy Trading

The Leaderboard comprises the platform’s best-performing Configurations. Those labeled as “Public” are available for cloning by any user. When you clone a Configuration, Aesir creates a duplicate of this particular crypto trading bot on your account, enabling immediate use for your benefit. Of course, there a word of caution that comes with Social / Copy Trading. When you clone a running configuration, you don’t copy existing positions as you can’t enter the market at a past date in time. So you might have slightly different results from the original creation whose strategy you’ve copied.

Paper Trading

Naturally, this brings us to another core feature for any crypto trader out there: the ability to test your strategies before taking them to market. We want to make sure that users trade responsibly, and thorough testing of a trading bot before deploying it is highly recommended. On top of paper-trading, we’re also currently considering how to add Backtesting as part of Aesir’s arsenal. Because Backtesting is computationally heavy, it will take a while to integrate nicely, but we’re definitely planning to add this feature.

Logic Layers

Going back to the example on how algorithmic trading apps work:

Buy ANY COIN on THIS EXCHANGE that GAINED more than 3% in the 2 MINUTES and the RSI is under 70

Logic layers are the core functionality behind Aesir. Logic layers effectively tell your cryptocurrency trading bot how to trade. The reason they’re called layers is because Aesir allows you to stack multiple bits of trading logic on top of each other, allowing you to create truly unique signals.

Here’s an example of how you can add two separate logic layers on top of one another:

The first one is a Volatility layer, as described in the examples above, and the second one is a TradingView Indicators layer, allowing you to quickly compute the signal status(BUY, SELL) of any moving average or oscillator.

Once you’ve selected a base and logic layers, AESIR will tell you exactly what the strategy that you created will do:

Test Strategy will trade USDT pairs with an order size of 10 USDT and a maximum of 3 Open Orders at a time. Assets will not be re-bought for 10 seconds. Buy and Sell signals for BTC, ETH, TRIBE, BIFI are checked every 30 seconds and an order will close when Take Profit reaches +2% or Stop Loss reaches -6%. 1. When a coin pair receives Buy Signals for 2 Moving Average(s) out of EMA10, EMA20, SMA20, and 1 Oscillator(s) out of CCI20, AO AND 2. once any of BTC, ETH, TRIBE, BIFI have gained at least 2% in the last 10 minutes an order will be triggered.

Enjoyed this article?

Sign up to the newsletter

You’ll receive more guides, articles and tools via e-mail. All free of course. But if you value this blog and its educational resources, you can subscribe to become a paid member for only $3 a month. This will keep the website open and free.