Pros and cons of using a Binance Trading bot

Trading bots for Binance have become an essential tool for many traders. They allow users to execute trades automatically, leveraging various strategies to capitalize on market movements round the clock.

This article offers an in-depth view of the best trading bots for Binance by comparing their Pros and Cons, in order to help you make the right decision.

But first, if you’re new to trading bots here are some of the main reasons to consider using ones, as well as some top considerations and risks to bear in mind before you start.

Why Use A Binance Trading Bot to begin with?

- 24/7 Trading: Cryptocurrency markets operate round-the-clock. Trading bots can operate at all hours, enabling traders to take advantage of opportunities even when they are not actively monitoring the markets. This can be particularly useful when looking to time breakouts for instance.

- Emotionless Trading: Bots follow predefined rules, eliminating emotional decisions that can lead to impulsive trading.

- Risk Free Testing: A good trading bot for Binance will allow you to first test your strategy either using Backtesting, Papertrading or both, before taking it to the live market thus minimizing the risk of deploying an untested strategy.

- Quicker Results: Users can test multiple trading strategies at the same time by deploying multiple bots to run concurrently. This is crucial in order to maximize profits during a specific market cycle.

Risks and Considerations

- Maintenance Required: A trading bot will require adjustments as market conditions change. No bot can operate under all market conditions.

- Security Risks: Users need to ensure that their API keys’ scope is properly restricted.

- Technical Knowledge: Some level of understanding is required to set up and configure a trading bot for Binance.

Best Binance trading bots, a quick glance

| Trading Bot | Pros | Cons |

|---|---|---|

| 3Commas | Portfolio Management, Multi Exchange Support, Automatic Rebalancing, Futures Trading, TradingView Integration, Trailing Up & Down, 3Commas API, Demo Account, Signals Backtest, Access to 15+ exchanges.

Pricing: Beginner Plan ($4/month), Pro Plan ($49/month), Expert Plan ($79/month). |

Limited features in the beginner plan, No Free tier |

| Aesir | Wide Range of Signals, Fast Execution, Social Hub, Volatility Scanner, Social/Copy Trading, Referral Bonuses, In-App Notifications, Email Notifications.

Pricing: Free Plan, Starter Plan ($16.67/month), Pro Plan ($34.17/month), Advanced Plan ($99.17/month). |

Limited strategies in Free Plan |

| Cryptohopper | Social Trading, Arbitrage Bots, Advanced Arbitrage, Trailing Stop Loss, DCA, Paper Trading.

Pricing: Pioneer Plan (Free), Explorer Plan ($24.16/month), Adventurer Plan ($57.50/month), Hero Plan ($107.50/month). |

Relatively expensive, Complex for beginners |

| UpBots | CEX and DEX portfolios in one place, Bot MarketPlace, Token Ecosystem.

Pricing: Pay as you go with UBXN tokens. |

Pricing can be unclear and variable, Requires holding UBXN tokens |

| Coinrule | Telegram Notifications, Paper Trading, Portfolio Risk Management.

Pricing: Free Plan, Hobbyist Plan ($39.99/month), Trader Plan ($79.99/month), Pro Plan ($499.99/month). |

Limited rules and strategies on lower-tier plans, High cost for Pro Plan |

| ArbitrageScanner.io | Notification, Matching fees, Opportunity Scanner.

Pricing: Subscription plans from $69 to $199 per month. |

Potentially high entry cost for full features |

| SMARD | Advanced Automated Trading, Designed for long term investment, No Configuration Required.

Pricing: $1 per month + 10% monthly service fee after profit. |

10% service fee might be high depending on profit, Limited information available |

| Bitsgap | Pre-Made Trading Bot Strategies, Multi-Exchange Trading Terminal.

Pricing: Basic ($23/month), Advanced ($55/month), Pro ($119/month). |

Basic plan might be limiting for serious traders |

| Shrimpy | Social Trading, Portfolio Rebalancing, Backtesting.

Pricing: Free Plan, Standard Plan ($20/month), Plus Plan ($49/month). |

Limited exchanges and portfolios on lower-tier plans |

| TradeSanta | Trade Terminal, Multi Exchange Support, Mobile App.

Pricing: Basic Plan ($25/month), Advanced Plan ($45/month), Maximum Plan ($90/month). |

Limited number of bots on lower-tier plans |

| CryptoHero | Arbitrage Trading, Lease or buy trading bots, Trading Terminal.

Pricing: Free, Premium ($13.99/month), Professional ($29.99/month). |

Limited bot access and higher execution speed on Free plan |

| Mudrex | Pre-built investment strategies, Portfolio Builder.

Pricing: Basic (Free), Pro ($16/month). |

Additional fees on deposits and withdrawals, Limited features on free plan |

| Haas Online | Backtesting & Paper Trading, Portfolio Management, HaasScript Editors, Custom Coded Trading bots.

Pricing: Lite+ ($9/month), Standard ($49/month), Professional ($99/month), Enterprise ($149/month). |

Advanced features locked behind higher tiers |

| Kryll | Portfolio Management, No Code Bot Builder, Bot marketplace.

Pricing: Varies with KRL holding and trading volume, up to $50/month without KRL. |

Complex pricing structure, Dependence on KRL holdings |

| Gunbot | DeFi Trading, Custom Coded Bots, Runs Locally.

Pricing: Standard ($29/month), Pro ($39/month), Ultimate ($59/month). |

Requires local setup and maintenance, Limited appeal for non-developers |

Before being able to use any of the trading bots in this list, you’re going to need a Binance API Key and Secret pair with the correct permissions.

How to Create a Binance API Key

- Log into your Binance Account: If you don’t have a Binance account, you’ll need to create one first. If you have an account, log in using your credentials.

- Navigate to API Management: Once logged in, click on your profile icon in the top-right corner of the screen. From the dropdown menu, select “API Management.”

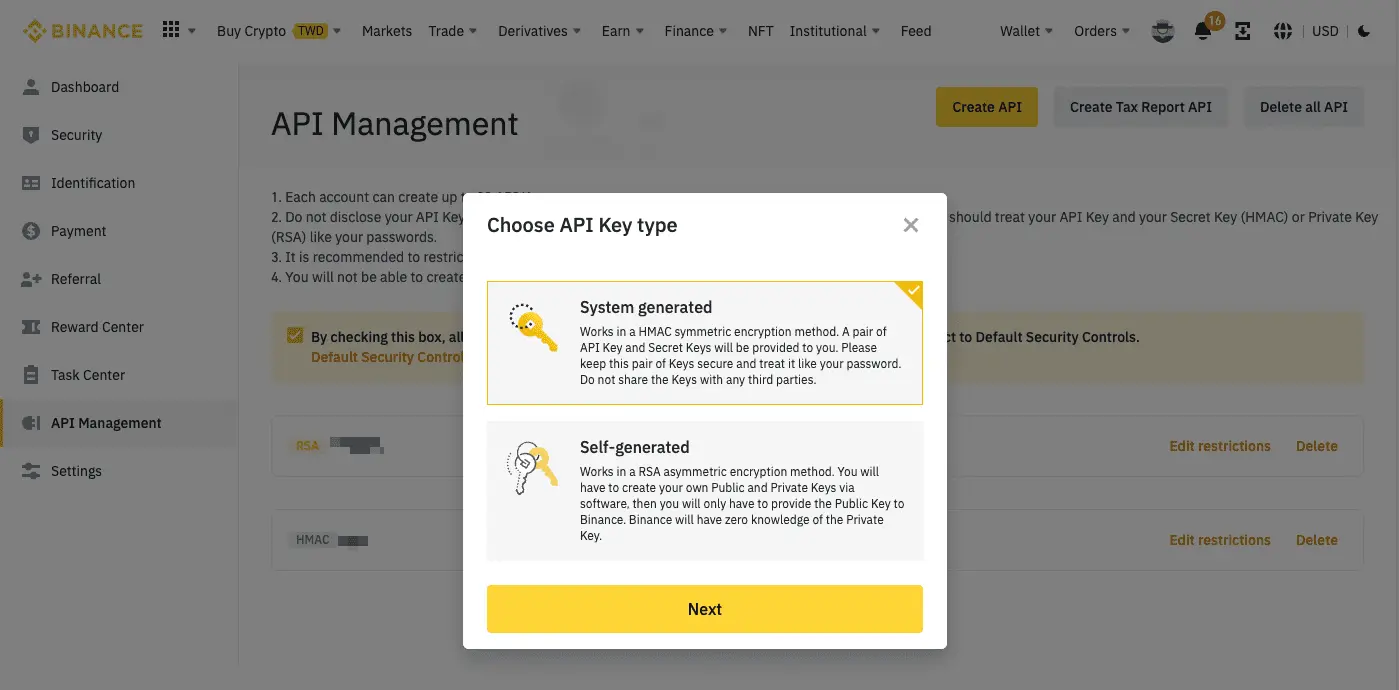

- Create a New API Key: In the API Management section, you’ll find a button to create a new API key. Click on it.

- Name Your API Key: Give your API key a recognizable and unique name. This will help you identify the purpose of the key later on.

- API Key Permissions: Binance offers several permissions that you can grant to your API key. These permissions determine what actions the key can perform, such as trading, withdrawal, or viewing balances. Choose the permissions that match your intended use for the API key. Be cautious and only grant the permissions you actually need to minimize potential security risks.

Note: For security purposes it’s strongly advised to only give your API Key the permissions that it will require. Aesir will NOT ask for access to Withdraw or Deposit funds on your behalf so keep these options disabled.

If everything looks good, click Generate Key. Note that you will only be able to see the private key once so make a note of it when it’s first presented to you, otherwise you will need to repeat the process.

After obtaining the key and secret pair, you can now integrate it into your trading bot for Binance.

Best Trading Bots for Binance, in detail

3Commas

3Commas is a general-purpose cryptocurrency trading platform that offers automated trading bots for various markets and across multiple exchanges. The platform provides users with a range of indicators and signals to choose from, as well as more advanced tools like SmartTrade, Portfolio management, and Smart Cover.

3Commas Key Features

- Portfolio Management: 3Commas offers a manual trade terminal where you can manage orders from multiple exchanges on a single platform. It also includes features such as trailing stop losses.

- Multi Exchange Support: 3Commas supports over 15 exchanges, making it easy for users to hop between multiple exchanges, or work with their favorite exchange.

- Automatic Rebalancing: Higher 3Commas tiers, such as Expert also get access to automatic re-investment of profits and Multi-pair DCA.

3Commas offers different subscription plans for trading on various exchanges, with different numbers of active bots, smart trades, grid bots, signal bots, and DCA bots. Traders can choose from monthly, annual, or lifetime subscriptions. Here are the pricing details for each plan:

3Commas Pricing

- Beginner Plan: This plan costs $4/month and includes 10 Active SmartTrades, 2 Running Signal Bots, 2 Running Grid Bots, 5 Running Single-Pair DCA Bots, and 25 Active DCA Deals.

- Pro Plan: This plan costs $49/month and includes 50 Active SmartTrades, 10 Running Signal Bots, 10 Running Grid Bots, 50 Running DCA Bots, 500 Active DCA Deals, and Multi-pair DCA.

- Expert Plan: This plan costs $79/month and includes Unlimited Active SmartTrades, 50 Running Signal Bots, 50 Running Grid Bots, 250 Running DCA Bots, 2500 Active DCA Deals, Multi-pair DCA, and Sub-Accounts connection.

All plans include Futures Trading, TradingView Integration, Trailing Up & Down, 3Commas API, Demo Account, Signals Backtest, and access to 15+ exchanges.

Aesir

Aesir is a new general-purpose algorithmic trading platform that offers unmatched execution speeds in the trading bot market, a wide range of trading strategies and advanced tools to help traders optimize their trades for different market conditions. Aesir is one of the best trading bots for Binance due to its unique and proprietary features such as the Volatility Scanner.

Aesir Key Features

- Wide Range of Signals: Aesir offers a wide range of signals and indicators to help you automate and optimize any trading strategy.

- Unique Volatility Scanner: Aesir was designed to take advantage of volatile crypto Markets with its unique Volatility Scanner logic layer. This allows traders to detect and capitalize on coins that are just about to pump.

- Fast Execution: Aesir was built for speed and it is currently one of the fastest trading bot platforms on the market.

- Social Hub: New and experienced users can easily duplicate other profitable configurations with a single click, making it the best trading bot for binance, especially for new users looking to get started quickly.

Aesir Pricing

Aesir offers different subscription plans for trading on various exchanges, with different numbers of active strategies, paper strategies, and frequency. Here are the pricing details for each plan:

- Free Plan: This plan includes 2 Strategies, 0 Paper Strategies, 60s Frequency, All Layers (logic modules), Trailing Stop Loss, and Copy Trading.

- Starter Plan: This plan costs $16.67 per Month and includes 4 Strategies, 4 Paper Strategies, 30s Frequency, All Layers, Trailing Stop Loss, and Copy Trading.

- Pro Plan: This plan costs $34.17 per Month and includes 15 Strategies, 15 Paper Strategies, 10s Frequency, All Layers, Trailing Stop Loss, and Copy Trading.

- Advanced Plan: This plan costs $99.17 per Month and includes 500 Strategies, 500 Paper Strategies, 10s Frequency, All Layers, Trailing Stop Loss, and Copy Trading.

All plans include Social/Copy Trading, Referral Bonuses, In-App Notifications, Email Notifications and Notifications.

Cryptohopper

Ultimately, the best trading bot for Binance, is the one that’s most suited for your needs.

Let’s continue down this list with Cryptohopper, a cryptocurrency trading platform that offers trading bots for various cryptocurrency markets. The platform provides users with a range of trading strategies, including DCA, Grid, Signal as well as futures.

Cryptohopper Key Features

- Social Trading: Similar to Aesir, Cryptohopper has an easy an intuitive interface Allowing you to clone other profitable strategies running on the platform.

- Arbitrage Bots: Cryptohopper offers Arbitrage bots that allow you to take advantage of price differences across different exchanges.

- Advanced Arbitrage: Higher tiers can take advantage of more complex arbitrage bots using Triangular Arbitrage Strategies.

Cryptohopper also includes other common features such as Trailing Stop Loss, DCA and Paper Trading.

Cryptohpper Pricing

Cryptohopper offers different subscription plans for trading on various exchanges, with different numbers of active bots, as well as gate-keeping powerful logic behind higher paid tiers. Cryptohopper is relatively more expensive compared to other solution, though it does offer a specialized set of features such as its advanced arbitrage so it might just be the tool of you if arbitrage is your strategy.

- Pioneer Plan: This plan is free and includes Unlimited Copy Bots, 20 open positions per exchange, and Portfolio Management.

- Explorer Plan: This plan costs $24.16/month and includes everything from Pioneer, 80 open positions per exchange, 10 min strategy interval checks, Scan markets with the power of 15 bots, 2 event-based triggers, Backtesting, Strategy Designer, Paper (simulated) trading, and Trading signals (Signalers).

- Adventurer Plan: This plan costs $57.50/month and includes everything from Explorer, 200 open positions per exchange, 5 min strategy interval checks, Scan markets with the power of 50 bots, 5 event-based triggers, and Market Making & Arbitrage.

- Hero Plan: This plan costs $107.50/month and includes everything from Adventurer, 500 open positions per exchange, 2 min strategy interval checks, Scan markets with the power of 75 bots, 10 event-based triggers, A.I. strategies and A.I designer, All coins for trading signals, and Extra Technical Indicators.

UpBots

UpBots is a DeFi-centric crypto trading bot with tokenomics closely tied to its pricing structure and its own bot marketplace economy. While UpBots might not be the best trading bot for Binance, it’s definitely a strong option to consider for DeFi trading. However, it does offer both CEX and DEX trading.

Upbots Features

- CEX and DEX portfolios in one place: UpBots allows you to have a complete view of your centralized AND decentralized portfolios. Track your wallets balance and evolution over time, connect to a bot or use Upbots’ own staking program to earn UBXN.

- Bot MarketPlace: Upbots allows users to buy or sell bots on their own internal marketplace.

- Token Ecosystem: Users are required to buy and hold UBXN in order to pay for various platform services such as executing trades, copying other bots and more.

Upbots Pricing

- No upfront fees: UpBots uses a pay as you go system, where you pay a certain amount of UBXN (UpBots’ own token) in order to keep your bots running. The exact cost is up to how much, or how little you use the application, the number of bots you run, and the number of trades you place, so it is not very clear what kind of price you’d be looking at. Upbots promises to refund your service fees so long as you don’t recover your losses.

Coinrule

Choosing the best trading bot for Binance, is not an easy task, but Coinrule might be the tool for you, if you’re looking for a trading bot platform to perform leveraged trades.

Coinrule Key Features

- Telegram Notifications: Coinrule offers live Telegram notifications to keep traders informed about their trading activity.

- Paper Trading: Coinrule’s paper trading feature allows traders to test their trading strategies in a risk-free environment before committing real funds.

- Portfolio Risk Management: Coinrule offers portfolio risk management tools to help traders manage their risk exposure.

In terms of execution speed, Coinrule promises “fast” execution speeds, however we were not able to confirm exactly what this means, so do test this if going for this option.

Coinrule Pricing

Coinrule offers four pricing plans to suit different trading needs:

- Free Plan: This plan offers two live rules, two demo rules, seven template strategies, one connected exchange, and up to $3,000 in monthly trade volume.

- Hobbyist Plan: This plan costs $39.99 per month and offers up to 40 template strategies, seven demo rules, connections to two exchanges, and trader community access.

- Trader Plan: This plan costs $79.99 per month and offers up to 100 template strategies, 10 demo rules, connections to three exchanges, and priority support.

- Pro Plan: This plan costs $499.99 per month and offers up to 500 template strategies, 50 demo rules, connections to five exchanges, and priority support.

All plans come with a monthly rolling subscription, which can be canceled at any time. Coinrule accepts crypto payments and is committed to the wider blockchain community.

ArbitrageScanner.io

ArbitrageScanner.io is a crypto arbitrage bot that helps traders identify price differences across crypto exchanges. It might not be the best trading bot for Binance overall, but if you’re looking for a specialized arbitrage software, this is a very good choice.

Arbitrage Scanner supports over 100,000 coins, 75+ exchanges, and 20 major blockchains. It also offers a scanner between exchanges that searches for spreads for you and sends you ready-made pairs for all coins with different parameters. This feature is available for PRO tariff and higher.

ArbitrageScanner.io Key Features

- Notification: Get 24/7 notifications of price difference across crypto-exchanges, including DEX.

- Matching fees: Matching withdrawal networks, withdrawal fees, pairing lifespan, liquidity, and percentage difference.

- Opportunity Scanner: A scanner between exchanges that searches for spreads for you and sends you ready-made pairs for all coins with different parameters.

ArbitrageScanner.io Pricing

ArbitrageScanner.io offers 2 subscription plans, at $69 to $199 per month. The cheapest plan offers a 30-day trial period, while the more expensive plans come with additional benefits such as turnkey scanner setup, and access to a closed community. The platform also provides free arbitrage training to all users.

SMARD

SMARD is an advanced automated trading software specifically designed for long term hands free investment. This means that unlike other tools on this list, you do not actually have to configure anything, the algorithm itself will manage your portfolio for you. While this may not be the best binance trading bot for everyone, it may prove as a solid long term investment strategy.

NOTE: We have not tested this software so we cannot speak to its profitability. Unfortunately many proprietary automated investment solutions are closed off with limited information into what the strategy actually does.

SMARD Key Features

Advanced Automated Trading: SMARD is an advanced automated trading software that utilizes proprietary algorithms to autotrade on their users behalf, with no configuration required by the end user.

Designed for long term investment: SMARD states that their algorithm will not take unnecessary risks, and it’s more of a long term investment tool rather than trading strategy.

No Configuration Required: Due to it being more of an algorithmic hedge fund, users are not required to configure their trading bots.

SMARD Pricing

SMARD charges $1 per month + 10% monthly service fee charge after you profit. The first payment will be made after one calendar month from the start of trading only.

Bitsgap

As our search for the best trading bot for Binance continues, we turn our attention to Bitsgap. If most of the platforms we’ve seen so far try to compete by offering the user a wide range of features, Bitsgap is playing a completely different game by offering 5 out of the box strategies with some customization. Those are: GRID, DCA, BTD (buy the dip), DCA FUTURES and COMBO (DCA+ GRID).

Bitsgap Key Features

- Pre-Made Trading Bot Strategies: Bitsgap offers a range of pre-made trading bot strategies that can be customized to suit individual trading needs.

- Multi-Exchange Trading Terminal: Bitsgap provides a single interface to trade across 25+ exchanges, including Binance, Bitfinex, and Coinbase Pro.

Bitsgap Pricing

- Basic: Priced at $23/month, this plan includes 2 active GRID bots, 10 active DCA bots, and unlimited smart orders.

- Advanced: Priced at $55/month, this plan includes 5 active GRID bots, 50 active DCA bots, and unlimited smart orders, as well as futures bots and trailing up & down for bots.

- Pro: Priced at $119/month, this plan includes 25 active GRID bots, 250 active DCA bots, and unlimited smart orders, as well as futures bots, trailing up & down for bots, and take profit for bots.

Shrimpy

Shrimpy is a general-purpose cryptocurrency trading bot that allows users to automate their trading strategies. The array of features it offers make it closer to Aesir, 3Commas and Cryptohopper, rather than some of the more specialized platforms we’e seen.

It offers a range of features that make it an attractive option for both novice and experienced traders.

Shrimpy Key Features

- Social Trading: Shrimpy’s social trading feature allows users to follow other traders and copy their trades. This is a great way for novice traders to learn from more experienced traders and improve their trading strategies.

- Portfolio Rebalancing: Shrimpy’s portfolio rebalancing feature allows users to automatically rebalance their portfolios based on their desired asset allocation. This helps users maintain a diversified portfolio and minimize risk.

- Backtesting: Shrimpy’s backtesting feature allows users to test their trading strategies against historical data to see how they would have performed in the past. This is a great way for users to refine their trading strategies and improve their performance.

Shrimpy Pricing

- Free Plan: The free plan includes unlimited spot trades but limits the user to one exchange, portfolio, and automation.

- Standard Plan: The standard plan costs $20 per month and includes access to five exchanges, portfolios, and automation, as well as customizable rebalance periods and dynamic indexing.

- Plus Plan: The plus plan costs $49 per month and includes access to 25 exchanges, 10 portfolios, and 10 automations, as well as customizable rebalance periods and dynamic indexing.

TradeSanta

TradeSanta is another general-purpose trading platform, making it a strong contender for the best trading bot for Binance. However, we did mention that there is rarely ever a best one-size fits all, and it’s usually a matter of preference.

TradeSanta Key Features

- Trade Terminal: Allows you to view and manage your positions across multiple exchanges in a single view.

- Multi Exchange Support: TradeSanta supports multiple exchanges.

- Mobile App: Create trading bots and manage your portfolio on the go using TradeSanta’s mobile app.

TradeSanta Pricing

TradeSanta offers three pricing plans:

- Basic Plan: This plan costs $25 per month and allows you to run up to 49 bots. It includes all strategies, trading terminal, trailing take profit, TradingView screener signals, custom TradingView signals, and futures bots.

- Advanced Plan: This plan costs $45 per month and allows you to run up to 99 bots. It includes all the features of the Basic Plan, as well as additional TradingView signals and strategies.

- Maximum Plan: This plan costs $90 per month and allows you to run an unlimited number of bots. It includes all the features of the Advanced Plan, as well as additional futures bots.

All plans come with a free trial, and TradeSanta accepts payments in fiat and crypto.

CryptoHero

Next up on our list if CryptoHero – a general purpose trading tool that, similar to Aesir, 3Commas and Cryptohopper, it offers customizable trading bots, a wide range of signals as well as TradingView Support. Is it the best binance trading bot for you though? Let’s take a look at the key features.

CryptoHero Key Features

Arbitrage Trading: CryptoHero offers traders access to a variety of arbitrage strategies such as inter-exchange arbitrage and intra-exchange arbitrage strategies. Lease or buy trading bots: You can earn a revenue by leasing your trading bot to be used by other traders, or conversely, pay a subscription fee for access to trader’s bot. Trading Terminal: CryptoHero allows you to manage all of your exchange trades in one holistic view.

CryptoHero Pricing:

- Free: Allows access to 1 trading bot, unlimited positions and offers the ability to short or long assets using simple trading bots. This plan has an execution speed of 15 minutes, making it quite limited in most cases.

- Premium: Allows access to up to 15 concurrent trading bots and offers Arbitrade and Advanced DCA bots as well. Starts at $13.99 a month. The execution speed of this plan is also 15m.

- Professional: With the professional plan at $29.99 a month, you can run up to 30 trading bots and also unlocks Grid type bots. The frequency is reduced to 5m which should be fine for longer-term investing, but not so much for scalping or day-trading.

Aesir on the other hand offers a 10 second frequency on the Pro plan, making it the fastest algotrading platform on the market. But then again the best trading bot for Binance, or any other exchange, is the one that most suits your needs.

Mudrex

Mudrex is a paid crypto trading bot that offers portfolio management, automatic trading techniques, risk management, and access to a trading strategy library. The bot is offered in two versions: Basic and Pro. The Basic plan is free and includes portfolio management and automatic trading techniques. The Pro plan costs a monthly membership charge and has more advanced features, such as risk management and access to a trading strategy library

Mudrex is closer in the range of features and overall approach to SMARD, in that it emphasizes long term investing using pre-built tools as opposed to swing, range or day-trading via a configurable crypto trading bot. Could this be the best binance trading bot for you to consider? Depends on your goals.

Mudrex Key Features

- Pre-built investment strategies: Mudrex offers a wide range of long term investment strategies for portfolio building. Users can subscribe to various packages depending on their risk tolerance. Some popular options are:

- Portfolio Builder: Mudrex also allows users to create their own portfolio of cryptocurrencies.

Mudrex Pricing

The Basic plan is free, while the Pro plan costs $16 per month. Mudrex also charges 0.5% on deposits and 2% on withdrawals, up to $10.

Haas Online

HaasOnline provides a general-purpose approach to trading, similar to 3Commas, Aesir as well as some of the other Trading Bots that we have discussed in this article, making it a strong choice for the best trading bot for Binance if you are looking for an all-rounder.

The platform offers four different plans: Lite+, Standard, Professional, and Enterprise. Each plan comes with its own set of features and pricing.

Haas Online Key Features

- Backtesting & Paper Trading: Test with historical & real-time data risk-free. Portfolio Management: Monitor your crypto assets and generate reports. HaasScript Editors: Rapidly develop trade bots, indicators, and more.

- Custom Coded Trading bots: Haas Online uses HaasScript language in order to allow users to create custom code trading bots.

Haas Online Pricing

- Lite+: This plan costs $9/month and comes with 3 trade bots, 15 open orders per bot, 1 month backtesting, 3 customizable dashboards, and 10 second tick interval.

- Standard: This plan costs $49/month and comes with 10 trade bots, 25 open orders per bot, 6 month backtesting, 10 customizable dashboards, and market intelligence.

- Professional: This plan costs $99/month and comes with 25 trade bots, 50 open orders per bot, 12 month backtesting, 25 customizable dashboards, signal manager, and expert precision and features to capitalize on all possible opportunities.

- Enterprise: This plan costs $149/month and comes with 25 trade bots, 50 open orders per bot, 12 month backtesting, 25 customizable dashboards, signal manager, and enterprise self-managed locally hosted TradeServer.

Kryll

Let’s continue our search for the best trading bot for Binance and take a look at Kryll. Now Kryll really mixes things up. Whether that’s good or bad is up to you. In terms of functionality Kryll offers a general-purpose approach, with undisclosed speeds of execution.

Kryll Key Features

- Portfolio Management: Kryll allows you to manage your portfolio from several exchanges under a single view.

- No Code Bot Builder: Similar to 3Commas or Aesir, Kryll offers a no-code builder that allows users to build their best binance trading bot in just a few clicks.

- Bot marketplace: Kryll offers a marketplace that allows users to buy and sell trading bots through the platform.

Kryll Pricing

This is where things get a little more complicated with Kryll. Kryll’s pricing model is directly related to how much KRL (Kryll’s own ERC-20 token) you hold in your wallet as well as your trading volume. At a $5000 monthly trading volume, Kryll’s pricing looks like so:

- No holding: Holding no Kryll, will cost you $50 a month for the Kryll subscription and you’ll get 99 trading bots and 10% Referral fee bonus.

- 5,000 Kryll: Holding around $2000 in Kryll at today’s price will bring your monthly subscription down to $42.50 a month, give you access to 119 trading bots, and a 25% referral bonus.

- 20,000 Kryll: Holding around $8000 in Kryll gets you a $32.50 a month sub price, 129 trading bots and a 30% referral bonus.

- 200,000 Kryll: This pricing model continues up to around $80,000 in Kryll, which brings your subscription down to $250 and gets you 399 bots and a 45% referral fee bonus.

Gunbot

Gunbot is a general-purpose trading bot designed to work with multiple exchanges, and supports DeFi trading as well. Gunbot is a bit different from most of the software we’ve reviewed above, in that your strategies don’t run in the cloud. Meaning that Gunbot doesn’t run your trading bots. Instead, you’ll need to download a piece of software and run it locally on your machine. Or a Raspberry Pi if you have one.

Gunbot Key Features

- DeFi Trading: On the highest tier plan, Gunbot offers access to DeFi trading through dYdX exchange.

- Custom Coded Bots: Gunbot allows traders to use code in order to code their own trading bots. While this is a nice feature to have, the appeal to custom code your bot, in order to run it locally and pay a subscription fee for doing so might be quite limited.

- Runs Locally: As mentioned before, Gunbot runs locally as a piece of software that you download and install. It is currently designed to run on Windows, Mac, Linux an Raspberry Pi.

Gunbot Pricing

- Standard: Costs $29/month and offers access to 1 exchange, unlimited trading pairs, telegram community and customer support. It also comes with access to All strategies and Gunbot’s AutoConfig – the ability to make modifications to a strategy programmatically, on the fly

- Pro: Costs $39/month and offers everything in Standard plus access to up to 3 Exchanges.

- Ultimate: At $59/month you get everything in Pro as well as DeFi support, unlimited API slots and custom-coded strategies.

Gunbot’s highest tier has some pretty nice features, but having to run it locally might not be everyone’s cup of tea for the best Binance trading bot.

Binance Trading Bots – Frequently Asked Questions

Let’s condense what we have learned in order to help you make the right choice and approach trading bots in a responsible manner.

What is the Best Trading Bot for Binance?

The best trading bot for Binance is the one that works best for you and your use cases. Whatever option you may choose, bear in mind that at the end of the day, all of these tools are there to help you optimize your existing strategy, and find new market opportunities, but they can’t make up for lack of knowledge or trading, and they are not magic money printers.

We would recommend starting with our own crypto trading bot, Aesir. Aesir is a state of the art algorithmic trading platform that allows you to automate your existing strategy, or find new ones through our social hub. It’s also the fastest algotrading platform on the market, and has a highly intuitive interface, that makes it easy for new and experienced traders to get started in minutes. Furthermore, we love to chat and we actively engage with our community on Discord.

How Much Do Trading Bots Cost?

The cost of trading bots can vary significantly, from free versions with basic functionalities to premium bots with advanced features and higher price tags. Even the pricing structure itself can vary from subscription-based to pay-as-you-go, and DeFi-centric pricing based on token holding.

At Aesir, we believe in the power of simplicity, so we did away with convoluted pay-as-you-go or DeFi pricing. Instead, we’re offering a straightforward monthly subscription.

How Safe Are Trading Bots?

White trading bots tend to be generally safe, the real answer here depends on several factors. First of all, in order to minimize any potential risk as a user, you need to ensure proper management of your API keys. Never give share them publicly, and always ensure that you don’t away more permissions than you have to.

In addition to this, you need to ensure that you follow trading best practices, and avoid deploying untested strategies on the live market.

Can Trading Bots Guarantee Profit?

No, bots cannot guarantee a profit. They are tools that can help execute strategies more efficiently, but their profitability depends on how you use them. Think of a trading bot as you favorite sports car. It’s really fast and can do incredible things, but only in the hands of a skilled driver.

How can I start building my first trading bot for Binance?

Glad ou asked! You can get started with Aesir here and don’t forget to join our Discord.

Enjoyed this article?

Sign up to the newsletter

You’ll receive more guides, articles and tools via e-mail. All free of course. But if you value this blog and its educational resources, you can subscribe to become a paid member for only $3 a month. This will keep the website open and free.

Originally posted on the Aesir Blog